During the term of the contract, the user may need to perform another recalculation. In this case, the same procedure applies as described in the previous chapters.

With regard to the Retroactive recalculation method, it can be generally stated that if the installments on the contract after recalculation are compared and on the contract with the same conditions but without recalculation, then the installments of the individual components of the total payment must be the same, with the exception of the Rim and Rim Accessories services.

An example is described below:

-

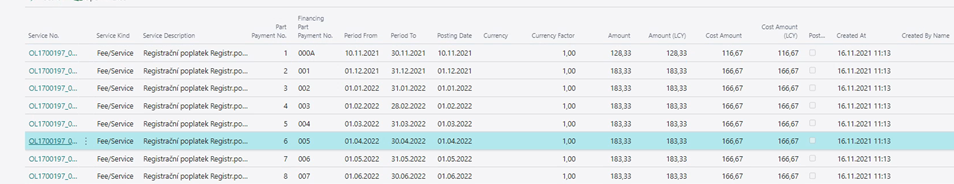

Contract OL1700197 is without recalculation, it currently has the following conditions:

Financing Period (in Months)=30

Yearly Distance=45000

Contractual Distance=112500

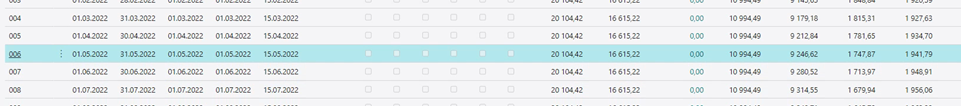

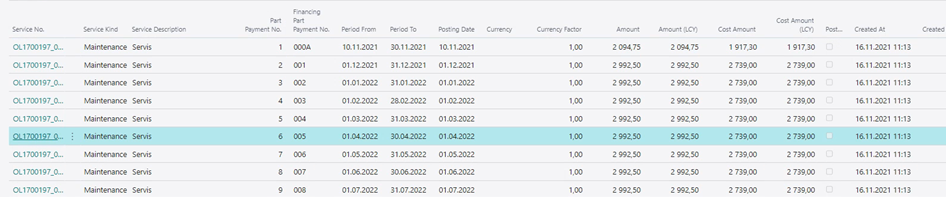

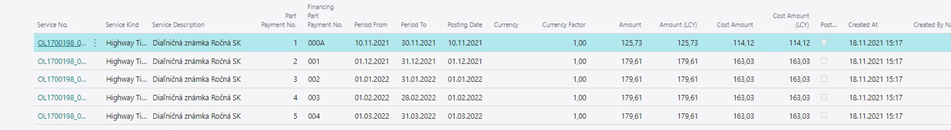

Payment schedule:

-

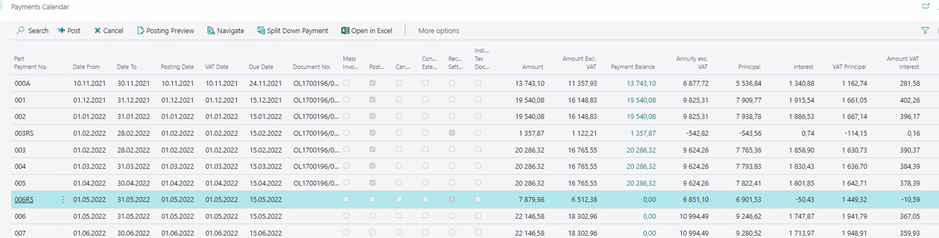

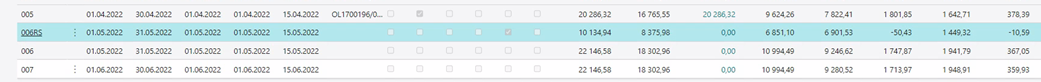

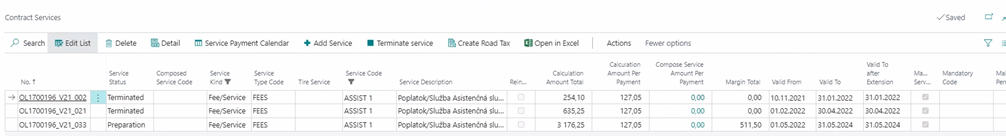

Contract OL1700196_V21 is after the second (i.e. repeated) recalculation (two RS lines), currently has the same conditions:

-

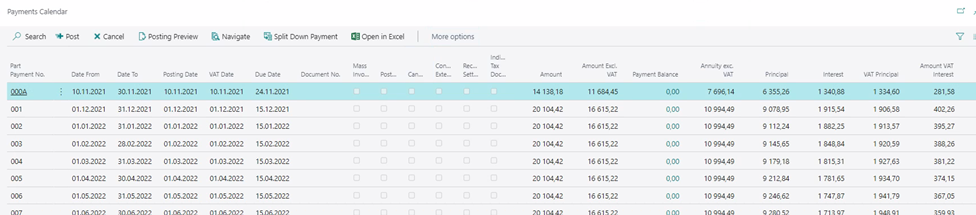

Annuity Comparison

-

Contract without recalculation has (payment 006):

-

Annuity Excl.VAT=10994.49

-

Principal=9246.62

-

Interest=1747.87

-

-

Contract after recalculation (payment 006):

-

Annuity Excl.VAT=10994.49

-

Principal=9246.62

-

Interest=1747.87

-

All three values are the same.

-

-

-

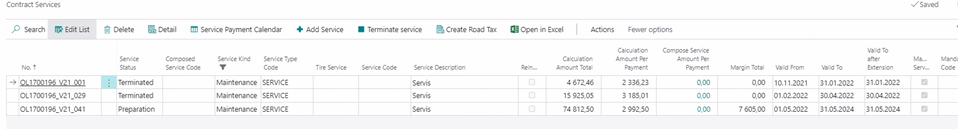

Maintenance Service

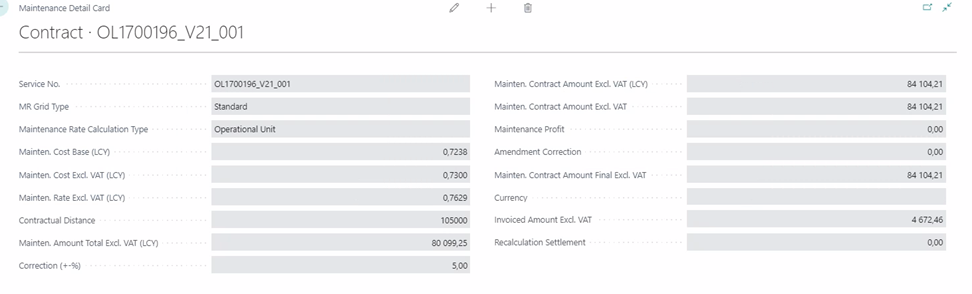

No.=..._001 (km=105000), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=84104.21

Invoiced Amount Excl.VAT = 2 x 2336.23 = 4672.46 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra).

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=always 0 on the first terminated service. (RS after recalculation is always written into the service that is valid after recalculation).

Calculation Amount Total (in Contract Services)=after recalculation, the Invoiced Amount Excl.VAT value from the detail is added.

Calculation Amount Per Payment=after writing Calculation Amount Total will no longer be recalculated over the number of payments without aliquot=2336.23.

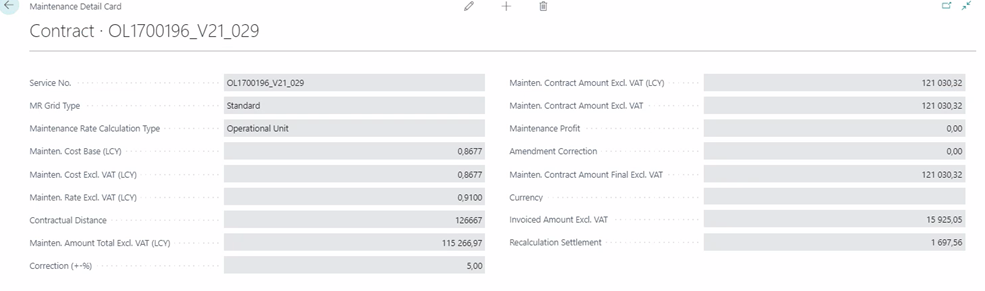

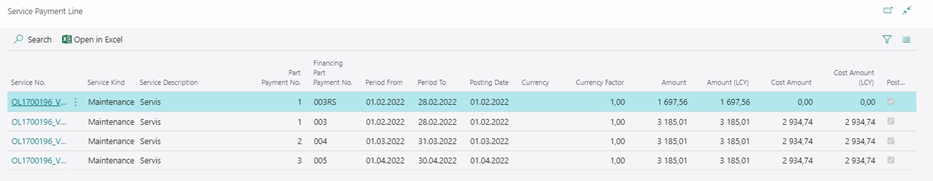

No.=..._029 (km=126667), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=121030.32

Invoiced Amount Excl.VAT = (first service 2*2336.23=4672.46) + (second service 1x 1697.56 + 3 x 3185.01=11252.59) = 15925.05 (the first recalculation completes for the first service, calculates RS, etc. Then the second recalculation also adds for the second service, in the Invoiced amount we also include recalcul.settlement).

Theoretically Invoiced=6370,02 (added during the first recalculation from the pace contract, which was based on the same conditions)

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 6370.02-4672.46=1697.56 – is on the service detail or the payment was created for this amount in the payment cal. service with the number 1-003RS.

Calculation Amount Total (in Contract Services)=after recalculation, the Invoiced Amount Excl.VAT value is added from the detail (after the second recalculation).

Calculation Amount Per Payment=on the terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the amount corresponds to the installment=3185.01.

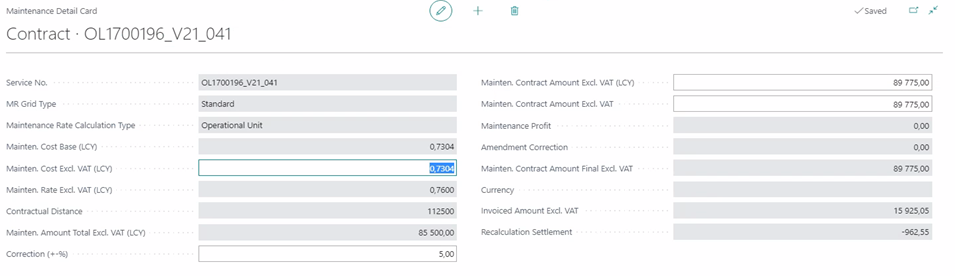

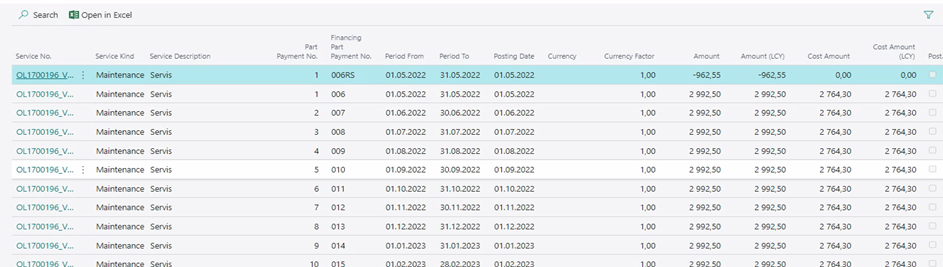

No.=..._041 (km=112500), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=89775.00

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, taken from the previous service = 15925,05

Theoretically Invoiced= 5 x 2992.50 = 14962.50 from the service of the second (tempo) contract.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 14962.50-15925.05=-962.55 – is on the service detail or the payment was created for this amount in the payment cal. service with the number 1-006RS (line for credit note).

Calculation Amount Total (in Contract Services) = after recalculation is added (total value 89775.00 - Theoretically Invoiced 14962.25) = 74812.50.

Calculation Amount Per Payment=Calculation Amount Total=74812.50/25 = 2992.50.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

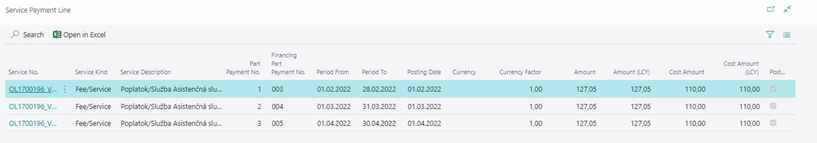

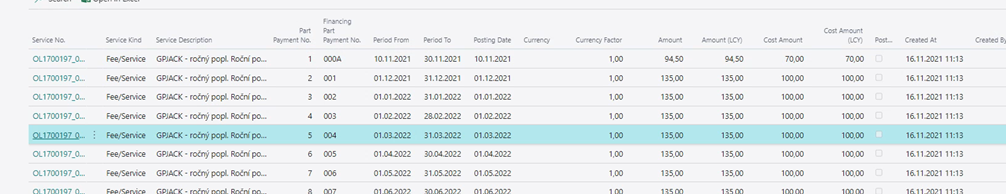

Fee/Service

-

Fee Period=Month

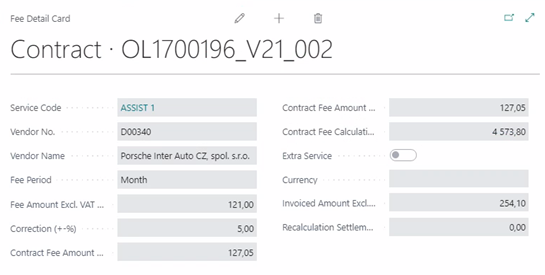

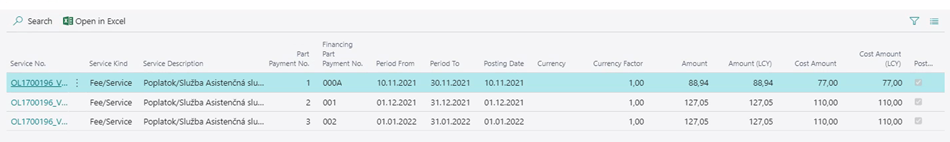

No.=..._002 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=36*127.05=4573.80

Invoiced Amount Excl.VAT = 2 x 127.05 = 254.10 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the Invoiced Amount Excl.VAT value is added from the detail.=254,10.

Calculation Amount Per Payment=on the terminated service, after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=127.05.

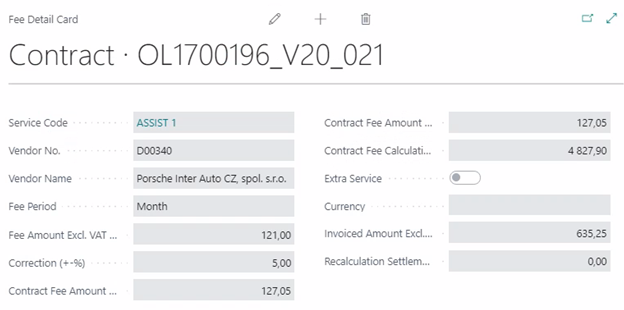

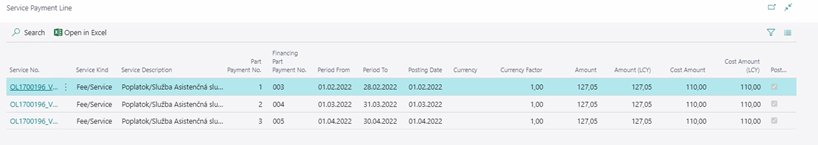

No.=..._021 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=38*127.05=4827.90

Invoiced Amount Excl.VAT = (first service 2*127.05=254.10)+(second service 3*127.05= 381.15)=635.25 (after the first recalculation there was 2*127.05=254.10. During the second recalculation, it was converted to the total value from both the first and second services).

Theoretically Invoiced=254.10 (from a tempo contract that was based on the same terms and conditions. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 254.10 -254.10 =0 – calculated after the first recalculation, the RS line was not created on the service detail or in the SPK of the service.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=635,25

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment.

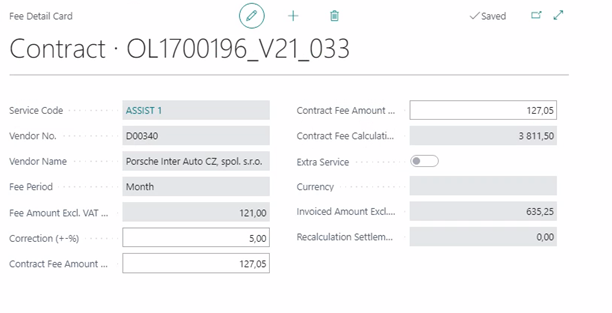

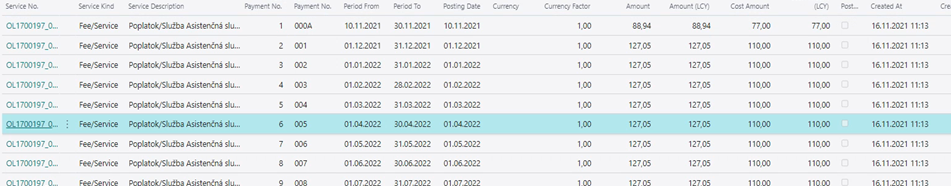

No.=..._033 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=30*127.05=3811.50

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken over from the previous service=635,25

Theoretically Invoiced= 5 x 127.05 = 635.25 from the service of the second contract:

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 635.25-635.25=0 – Rec.Settlement cannot be created on the monthly fee (i.e. not even an RS line).

Calculation Amount Total (in Contract Services) = after recalculation is completed (total value 3811.50 - Theoretically Invoiced 635.25) = 3176.25.

Calculation Amount Per Payment=Calculation Amount Total=3176.25/25 = 127.05.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

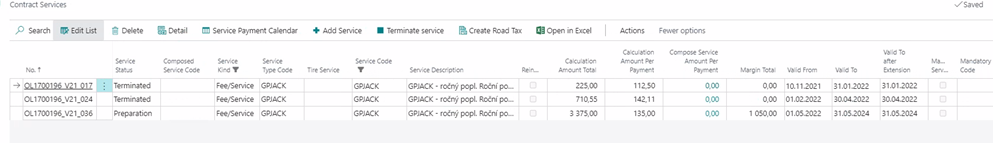

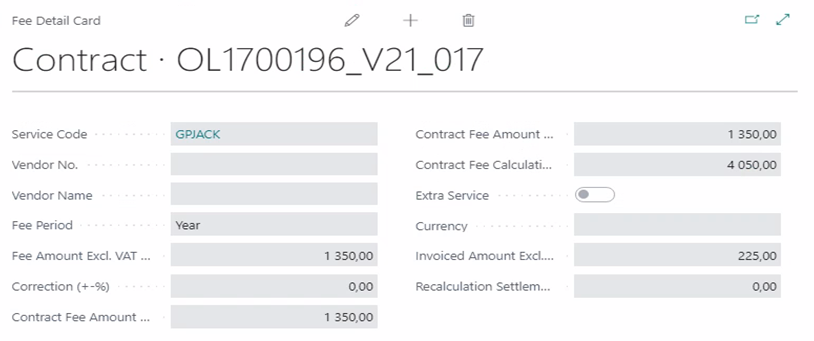

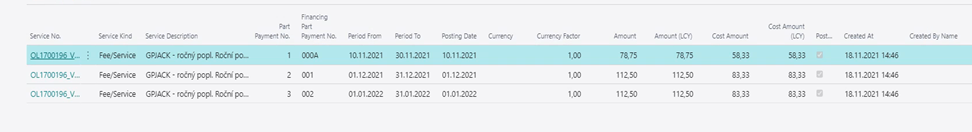

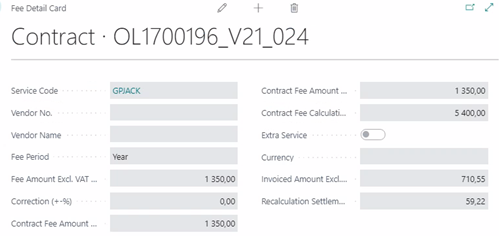

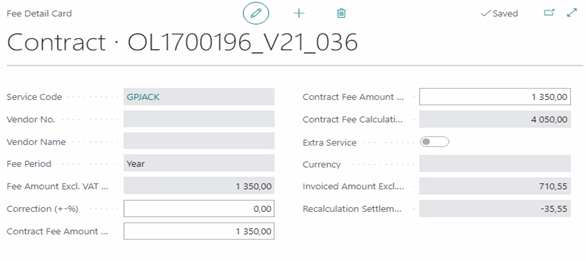

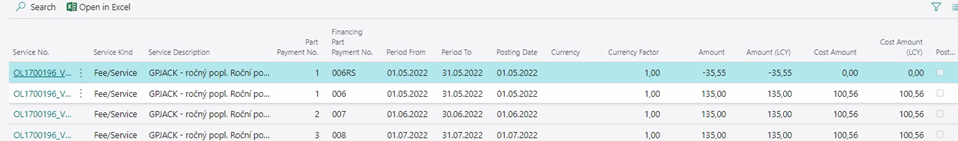

Fee Period=Year

No.=..._017 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=(36/12)*1350=4050

Invoiced Amount Excl.VAT = 2 x 112.50 = 225 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the Invoiced Amount Excl.VAT value is added from the detail.=225,10 (i.e. without aliquot payment).

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=112.50.

No.=..._024 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=roundup((38/12); 0)*1350=5400

Invoiced Amount Excl.VAT = (first service 2*112.50=225)+(second service 59.22+3*142.11= 485.55)=710.55 (after the first recalculation there was 2*112.50=225. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=284.22 (from a tempo contract that was on the same based on the same conditions. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 284.22 -225 =59.22 – calculated after the first recalculation, it is also on the service detail in the paym. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=710,55

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 142.11

No.=..._036 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=roundup((30/12; 0)*1350=4050

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken from the previous service=710,55

Theoretically Invoiced= 5 x 135 = 675 from the Tempo Service (spk. cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 675-710.55=-35.55 – Rec.Settlement is an overpayment:

Calculation Amount Total (in Contract Services) = after recalculation is added (total value 4050 - Theoretically Invoiced 675) = 3375.

Calculation Amount Per Payment=Calculation Amount Total=3375/25 = 135.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

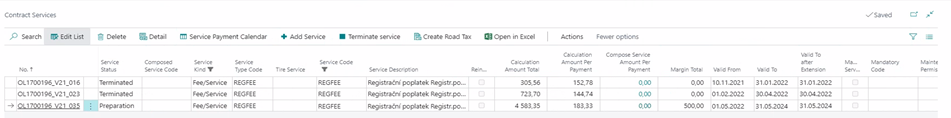

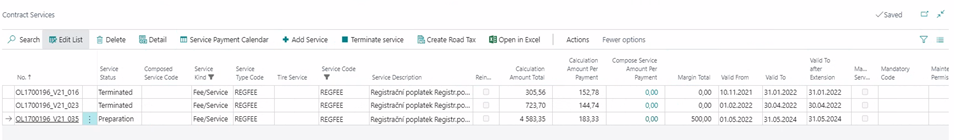

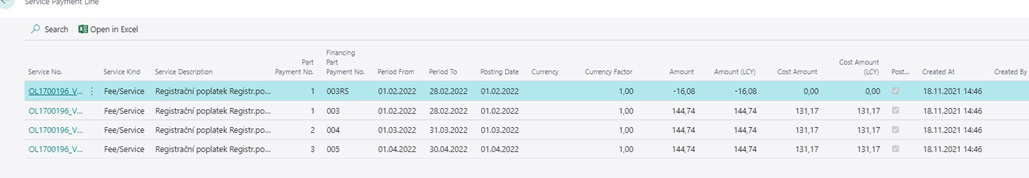

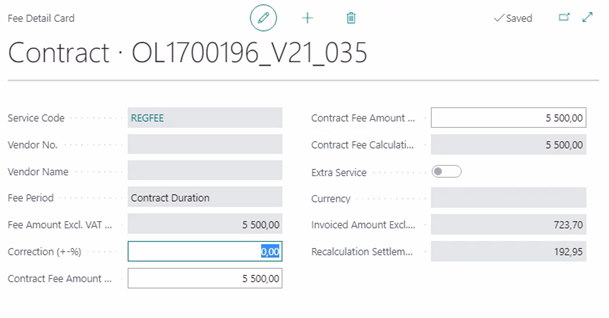

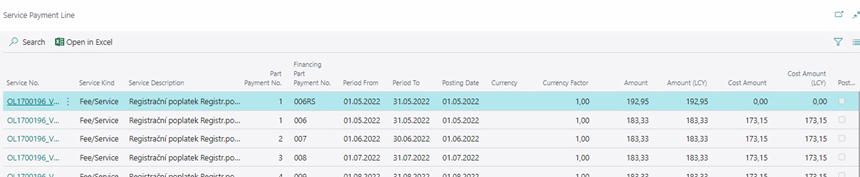

Fee Period=Contract Duration

No.=..._016 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=1*5500=5500

Invoiced Amount Excl.VAT = 2 x 152.78 = 305.56 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the value of Invoiced Amount Excl.VAT from detail=305.56 (i.e. without aliquot payment) is added.

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=152.78.

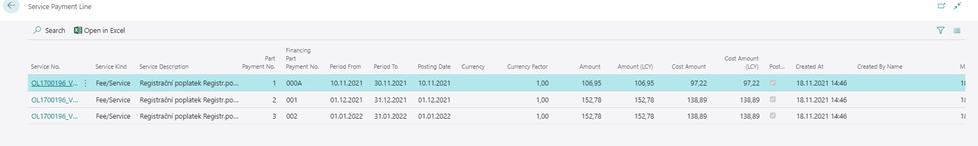

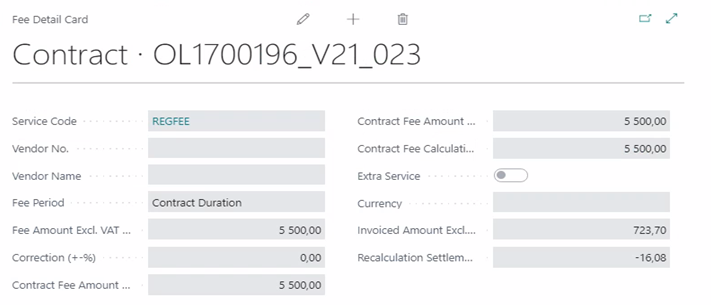

No.=..._023 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=1*5500=5500

Invoiced Amount Excl.VAT = (first service 2*52.78=305.56)+(second service -16.08+3*144.74= 418.14)=723.70 (after the first recalculation there was 2*52.78=305.56. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=289.48 (from a tempo contract that was on the same based on the same terms. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 289.48 -305.56 =-16.08 – calculated after the first recalculation, it is also in the payment cal. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value of Invoiced Amount Excl.VAT from detail is added=723,70

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 144.74

No.=..._035 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=1*5500=5500

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken from the previous service=723,70

Theoretically Invoiced= 5 x 183.33 = 916.65 from the tempo service (spk.cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 916.65-723.70=192.95 – Rec.Settlement is invoicing:

Calculation Amount Total (in Contract Services)=after recalculation it will be filled in (total value 5500 - Theoretically Invoiced 916.65) = 4583.35

Calculation Amount Per Payment=Calculation Amount Total=4583.35/25 = 183.33.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

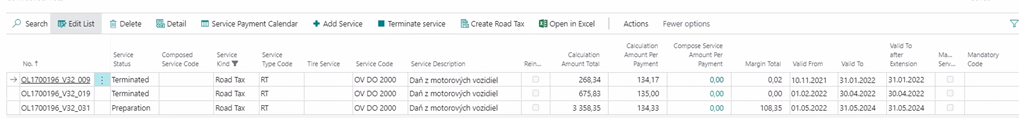

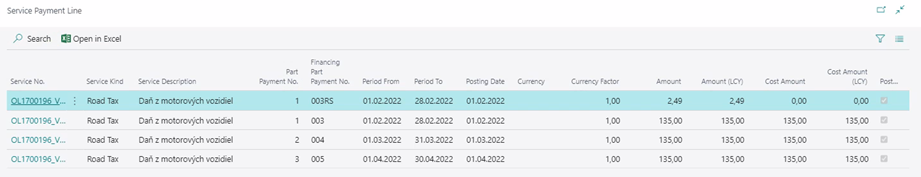

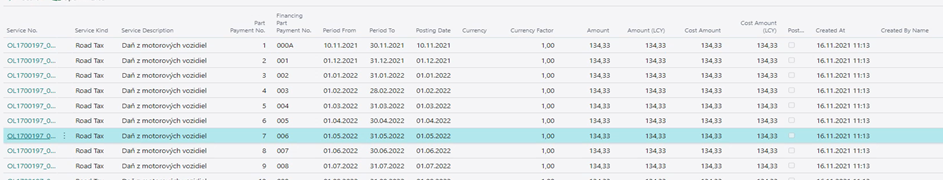

Road Tax service (ukážka z varianty _32)

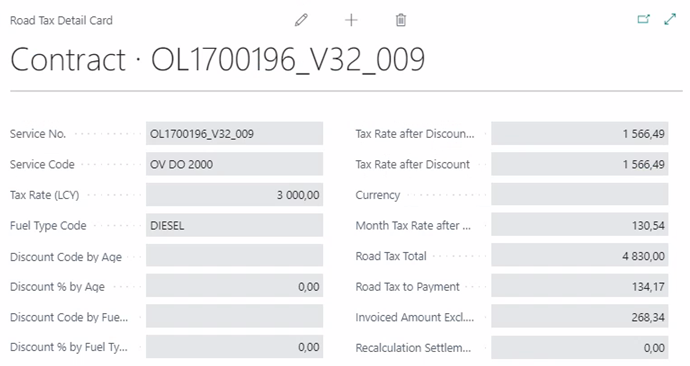

No.=..._009 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=4830

Invoiced Amount Excl.VAT = 2 x 134.17 = 268.34 (we do not include the first aliquot in the Invoiced amount, because the first aliquot is as if extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the Invoiced Amount Excl.VAT value from the detail is added.=268,34

Calculation Amount Per Payment=on the terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=134,17.

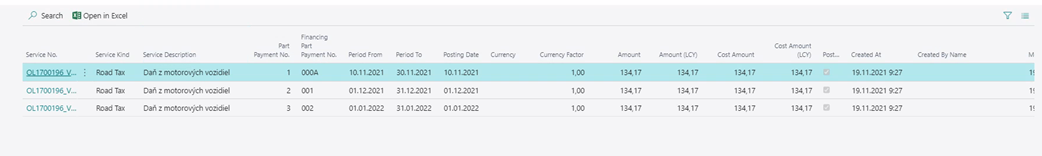

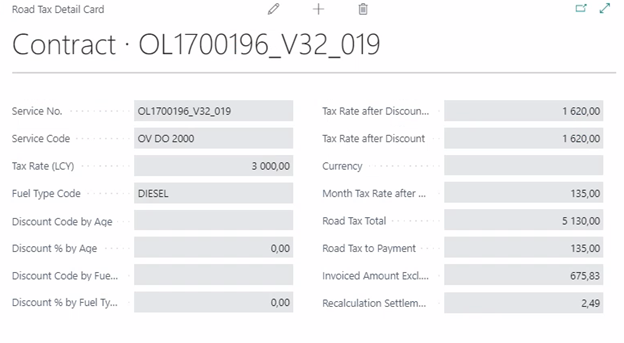

No.=..._019 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=5130

Invoiced Amount Excl.VAT = (first service 2*134.17=268.34)+(second service 1*2.49 + 3*135= 407.49)=675.83 (after the first recalculation there was 268.34. During the second recalculation, it was converted to the total value from both the first and second services).

Theoretically Invoiced=270 (from a tempo contract that was on the same based on the same conditions. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 270 – 268.34 = 2.49 – calculated after the first recalculation, the RS line was created on the service detail or in the SPK of the service.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=675,83

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of installment=135

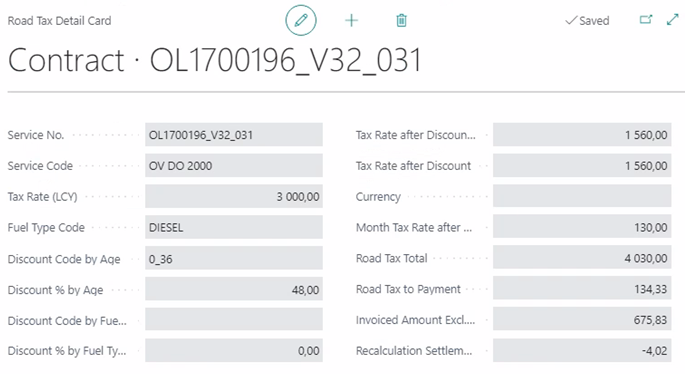

No.=..._031 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was= 4030

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken from the previous service=675,83

Theoretically Invoiced= 5 x 134.33 = 671.65 from the service of the second contract

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 671.65-675.83=-4.18 overpayment:

Calculation Amount Total (in Contract Services) = after recalculation is completed (total value 4030 - Theoretically Invoiced 671.65) = 3358.35.

Calculation Amount Per Payment=Calculation Amount Total=3358.35/25 = 134.33.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

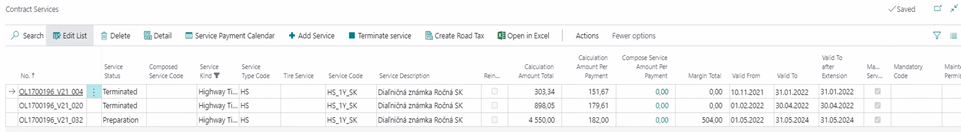

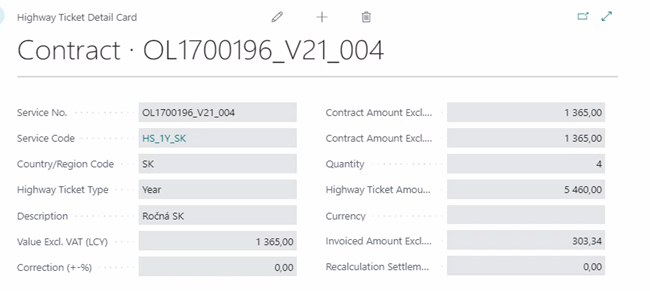

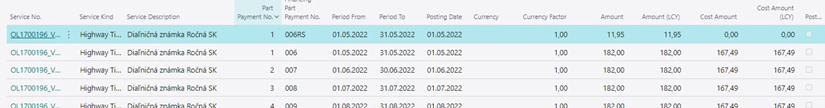

Highway Ticket Service

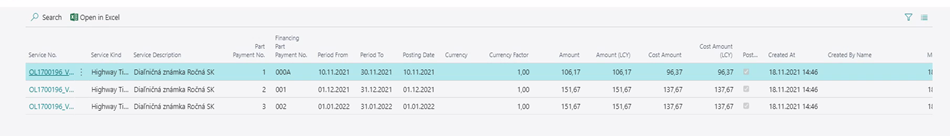

No.=..._004 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=4*1365=5460

Invoiced Amount Excl.VAT = 2 x 151.67 = 303.34 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from the detail is added.=303.34 (i.e. without aliquot payment).

Calculation Amount Per Payment=on the terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=151.67.

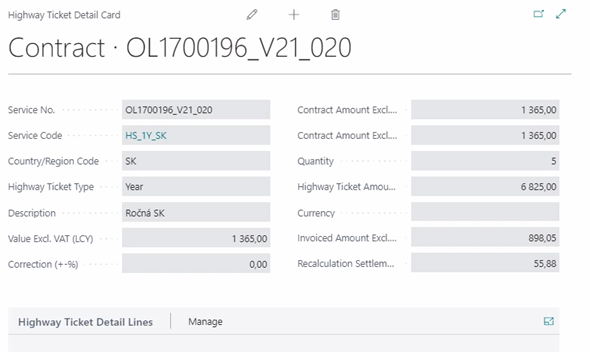

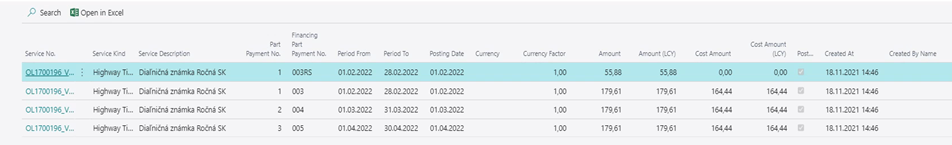

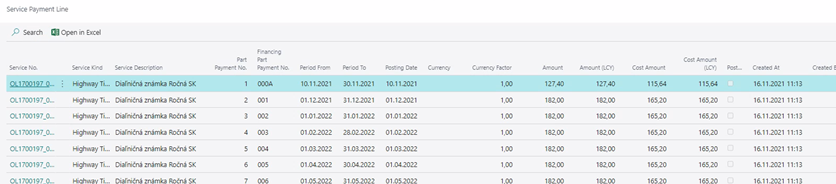

No.=..._020 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=5*1365=6825

Invoiced Amount Excl.VAT = (first service 2*151.67 = 303.34)+(second service 55.88+3*179.61= 594.71)=898.05 (after the first recalculation there was 2*151.67 = 303.34. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=2*179.61=359.22 (from a tempo contract that was based on the same conditions on the same terms. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 359.22 -303.34 =55.88 – calculated after the first recalculation, it is on the service detail also in the payment cal. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=898,05

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 179.61

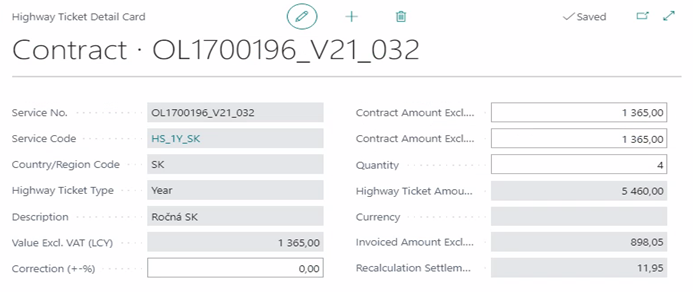

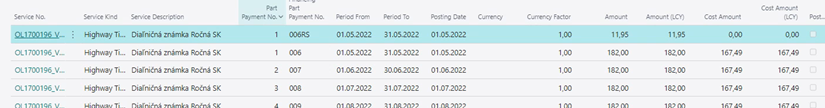

No.=..._032 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=4*1365=5460

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken from the previous service=898,05

Theoretically Invoiced= 5 x 182 = 910 from the Tempo Service (spk. cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 910-898.05= 11.95 Rec.Settlement is invoicing:

Calculation Amount Total (in Contract Services) = after recalculation it is filled in (total value 5460 - Theoretically Invoiced 910) = 4550.

Calculation Amount Per Payment=Calculation Amount Total=4550/25 = 82.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

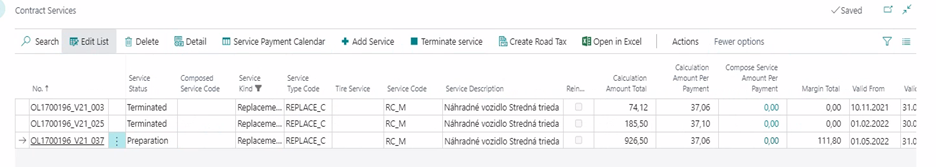

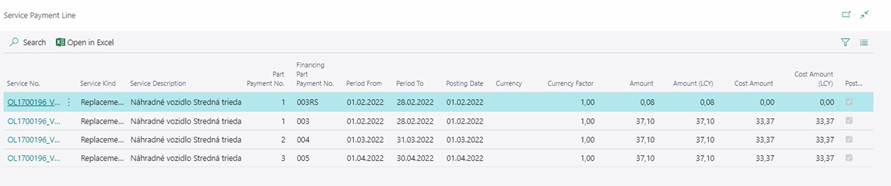

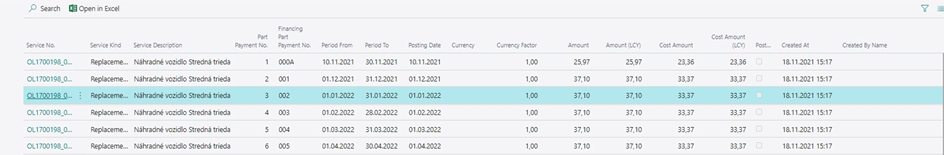

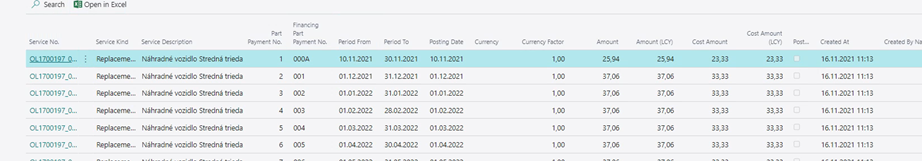

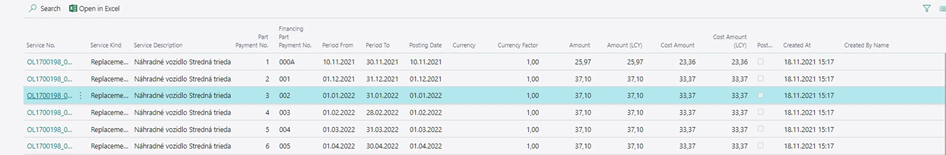

Replacement Car Service

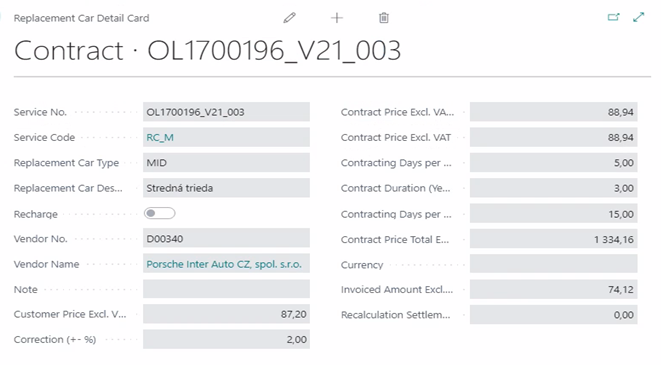

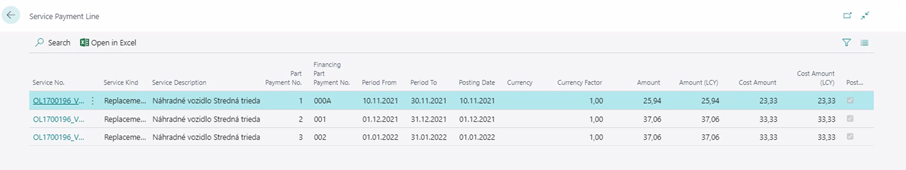

No.=..._003 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=1334.16

Invoiced Amount Excl.VAT = 2 x 37.06= 74.12 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the Invoiced Amount Excl.VAT value is added from the detail.=74.12 (i.e. without aliquot payment).

Calculation Amount Per Payment=on the terminated service, after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=37.06.

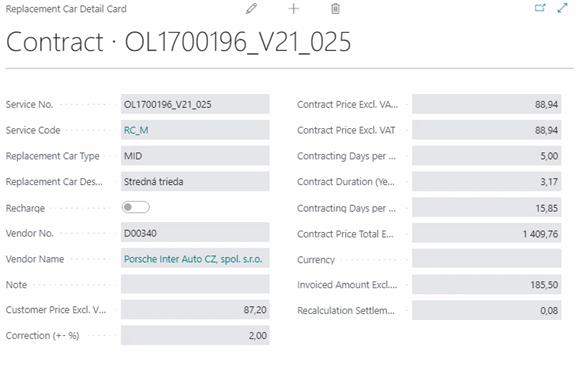

No.=..._025 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=1509.76

Invoiced Amount Excl.VAT = (first service 2*37.06 = 74.12)+(second service 0.08+3*37.10= 111.38)=185.50 (after the first recalculation, there was 2*151.67 = 303.34. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=2*37,10=74,2 (from a tempo contract that was on the same based on the same conditions. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 74.2 -74.12 = 0.08 – calculated after the first recalculation, it is also on the service detail in the payment cal. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=185,50

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 37.06

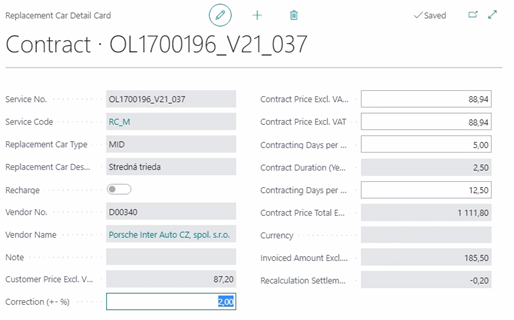

No.=..._037 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=1111.80

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken from the previous service=185,50

Theoretically Invoiced= 5 x 37.06 = 185.30 from the service from the tempo service (spk.cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 185.30-185.50= -0.30 Rec.Settlement is a credit memo:

Calculation Amount Total (in Contract Services) = after recalculation is completed (total value 1111.80 - Theoretically Invoiced 185.30) = 926.50.

Calculation Amount Per Payment=Calculation Amount Total=926.50/25 = 37.06.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

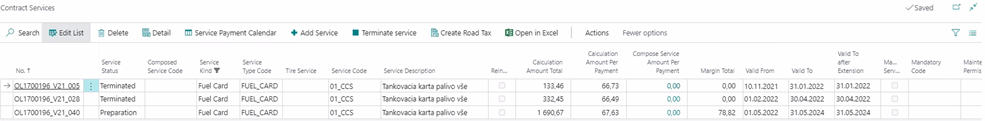

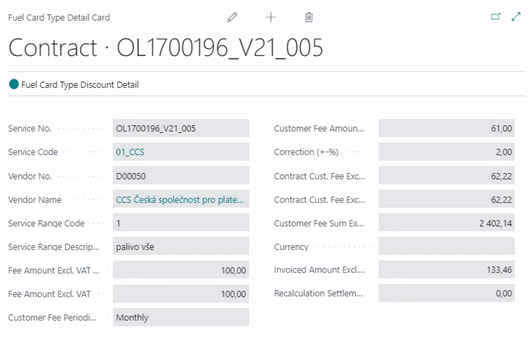

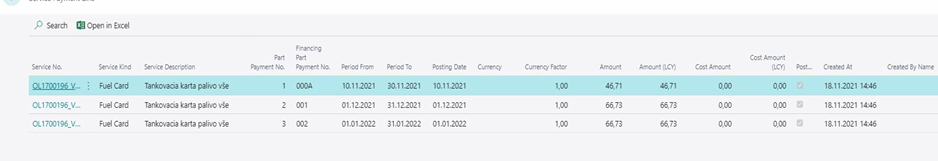

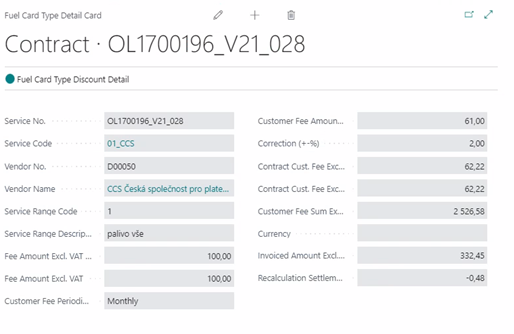

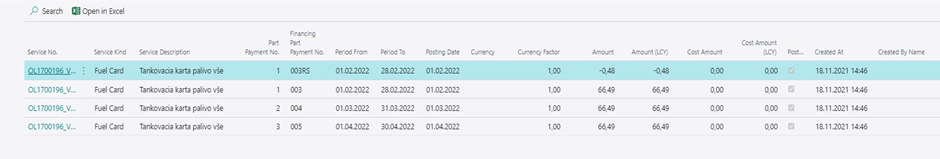

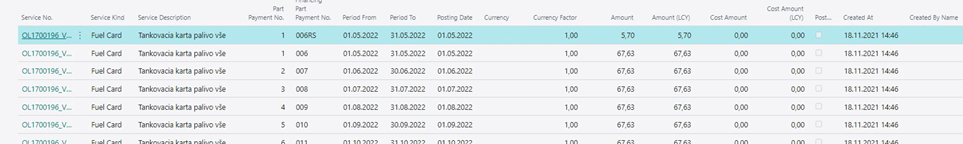

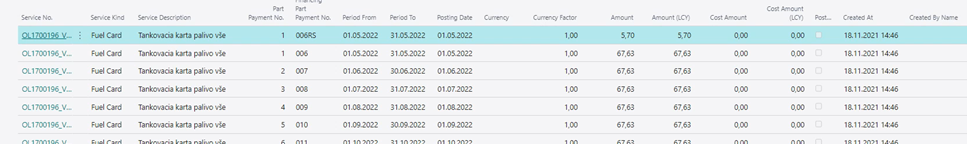

Fuel Card Service

No.=..._005 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=2402.14

Invoiced Amount Excl.VAT = 2 x 66.73= 133.46 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the value of Invoiced Amount Excl.VAT is added from the detail.= 133.46 (i.e. without aliquot payment).

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=66,73

No.=..._028 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=2526.58

Invoiced Amount Excl.VAT = (first service 2*66.73 = 133.46)+(second service -0.48+3*66.49= 198.99)=332.45 (after the first recalculation there was 2*66.73 = 133.46. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=2*66.49=132.98 (from a tempo contract that was on the same based on the same conditions. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 132.98 -133.46 = 0.08 – calculated after the first recalculation, it is on the service detail also in pay.cal. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=332,45

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 66.49

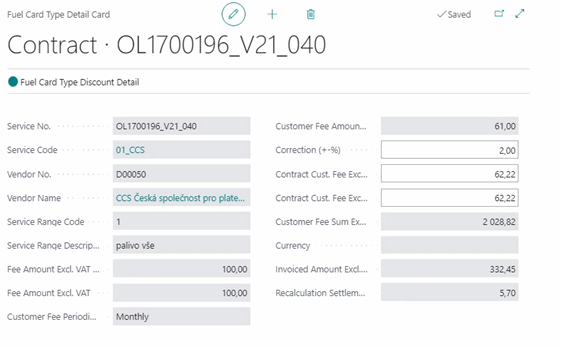

No.=..._040 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=2028.82

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken over from the previous service=332,45

Theoretically Invoiced= 5 x 67.63 = 338.15 from the Tempo Service (spk.cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 338.15-332.45= 5.7 Rec.Settlement is invoiced:

Calculation Amount Total (in Contract Services)=after recalculation it will be filled in (total value 2028.82 - Theoretically Invoiced 338.15) = 1690.67

Calculation Amount Per Payment=Calculation Amount Total=1690.67/25 = 67.63.

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

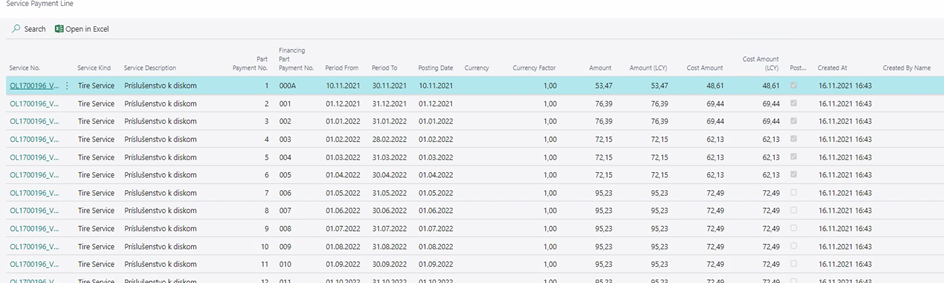

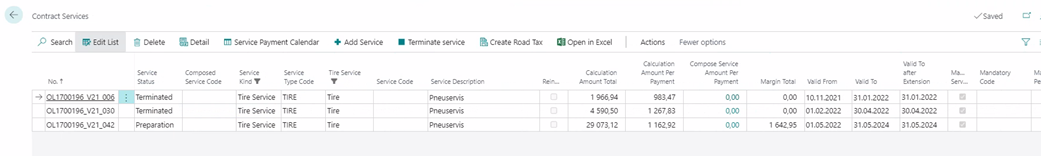

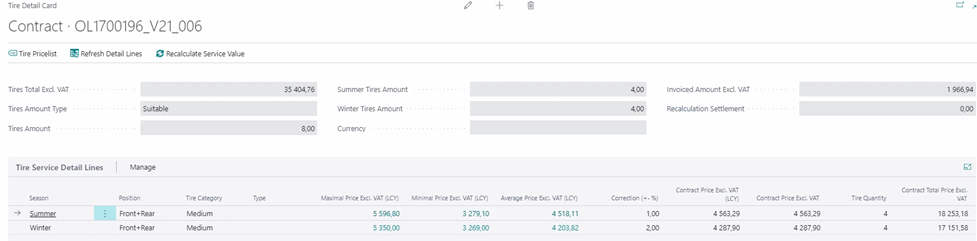

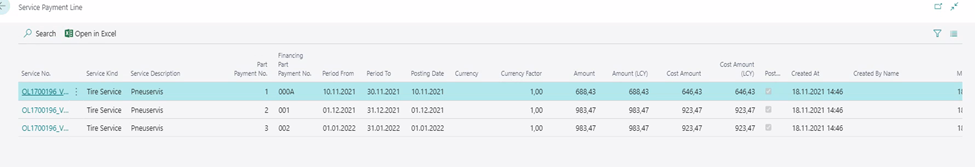

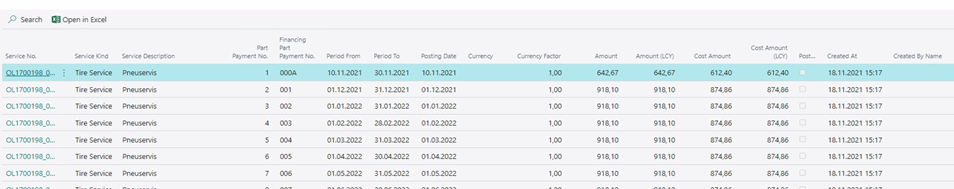

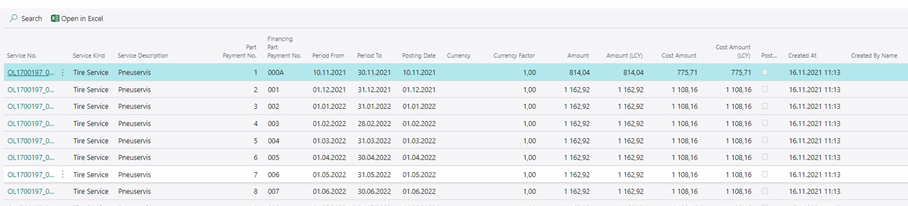

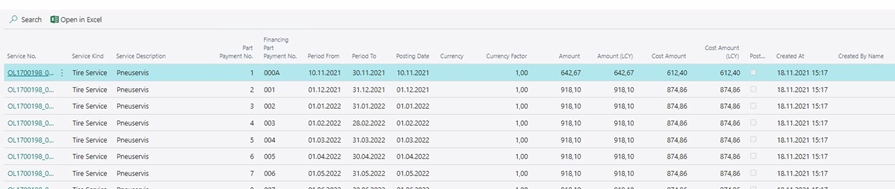

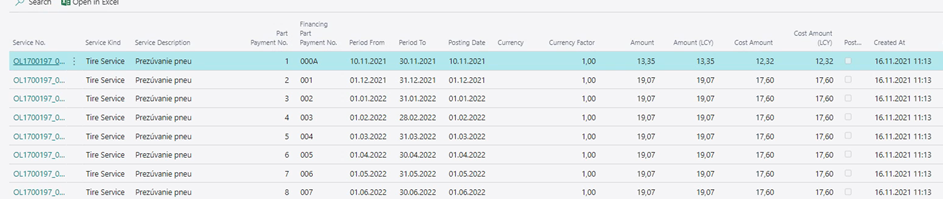

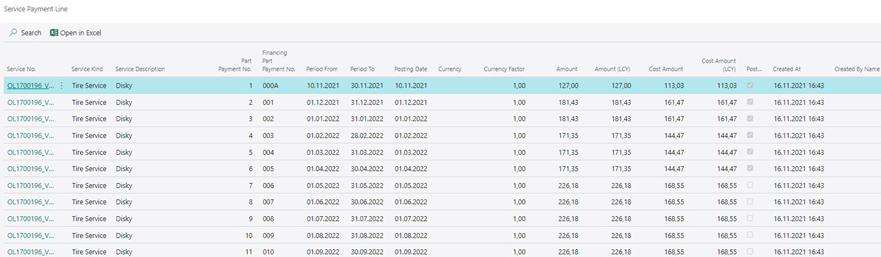

Tireservice/Tire Service

No.=..._006 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=35404.76

Invoiced Amount Excl.VAT = 2* 983.47= 1966.94 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services) = after recalculation the value of Invoiced Amount Excl.VAT is added from the detail.= 1966.94 (i.e. without aliquot payment).

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=983,47

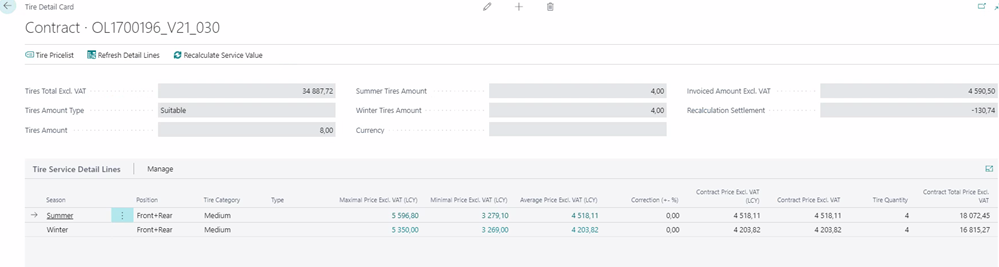

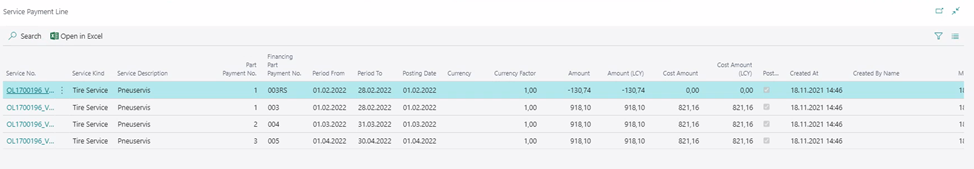

No.=..._030 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=34887.72

Invoiced Amount Excl.VAT = (first service 2* 983.47= 1966.94)+(second service -130.74+3*918.10= 2623.56)=4590.50 (after the first recalculation there was 2* 983.47= 1966.94. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=2*918,10=1836,20 (from a tempo contract that was based on the same terms and conditions. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 1836.20 -1966.94 = -130.74 – calculated after the first recalculation, it is also in the service detail in the payment cal. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=4590,50

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 918.10

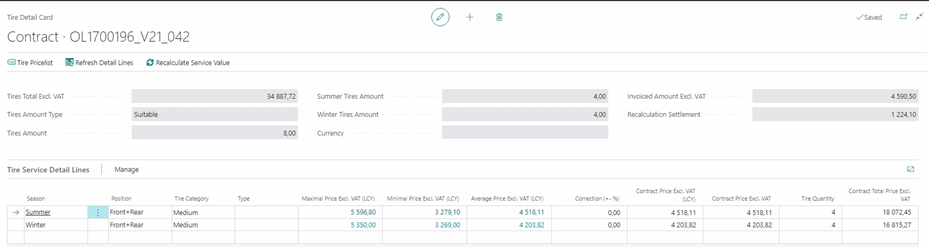

No.=..._042 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=34887.72

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken from the previous service=4590,50

Theoretically Invoiced= 5 x 1162.92 = 5814.60 from the service from the tempo service (spk. cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 5814.60-4590.50=1224.10 Rec.Settlement is invoicing:

Calculation Amount Total (in Contract Services)=after recalculation it will be filled in (total value 34887.72 - Theoretically Invoiced 5814.60) = 29073.12

Calculation Amount Per Payment=Calculation Amount Total=29073.12/25 = 1162.92

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

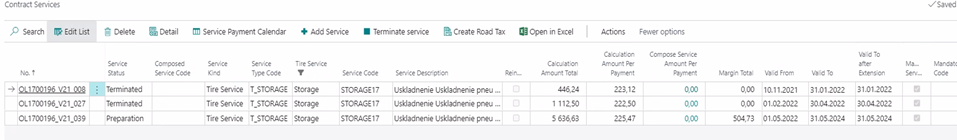

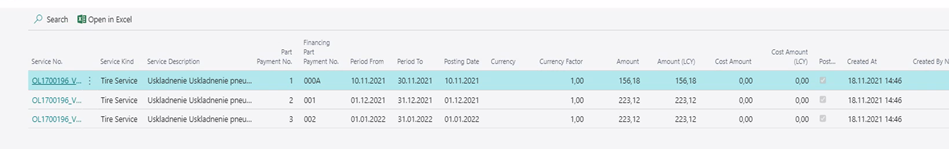

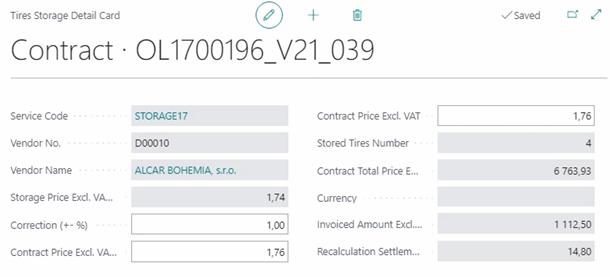

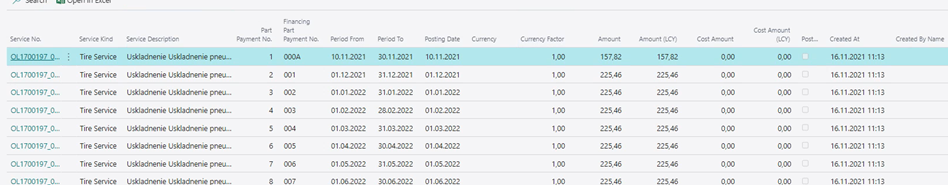

Služba Tire Service/Tire Storage

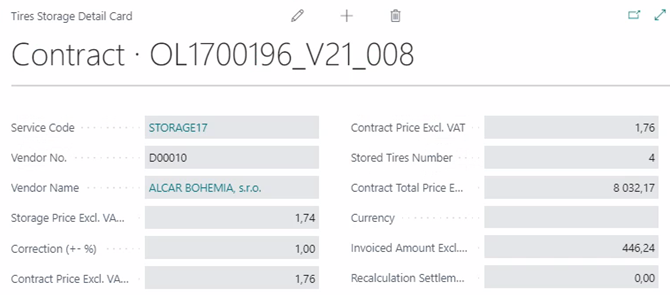

No.=..._008 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=8032.17

Invoiced Amount Excl.VAT = 2* 223.12= 446.24 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the value of Invoiced Amount Excl.VAT is added from the detail.= 446.24 (i.e. without aliquot payment).

Calculation Amount Per Payment=at the terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=223,12

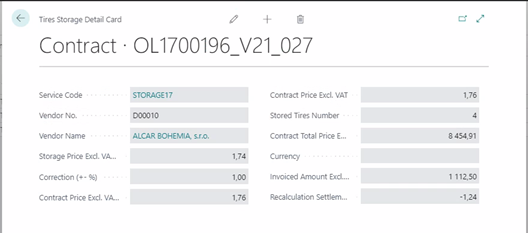

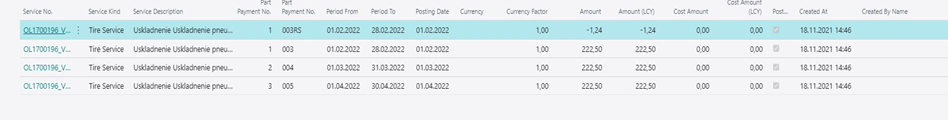

No.=..._027 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=8454.91

Invoiced Amount Excl.VAT = (first service 2*223.12=446.24)+(second service -1.24+3*222.50= 666.26)=1112.50 (after the first recalculation there was 2*223.12=446.24. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=2*222,50=445 (from a tempo contract that was based on the same conditions on the same terms. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 445 - 446.24 = -1.24 – calculated after the first recalculation, it is also in the payment cal. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value Invoiced Amount Excl.VAT from detail is added=1112,50

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 222.50

No.=..._039 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=6763.93

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, it is taken over from the previous service=1112,50

Theoretically Invoiced= 5 x 225.47 = 1127.35 from the service from the tempo service (spk.cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 1127.35-1112.50=14.80 Rec.Settlement is invoicing:

Calculation Amount Total (in Contract Services)=after recalculation it will be filled in (total value 6763.93 - Theoretically Invoiced 1127.35) = 5636.58

Calculation Amount Per Payment=Calculation Amount Total=5636.58/25 = 225.46

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

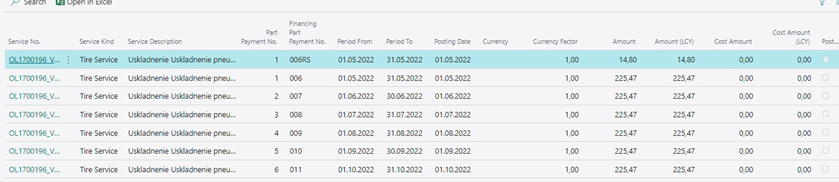

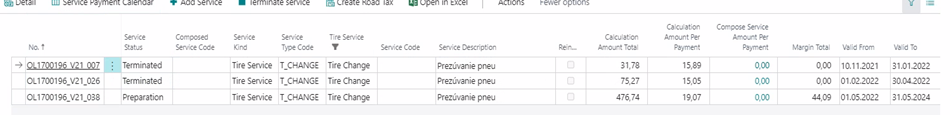

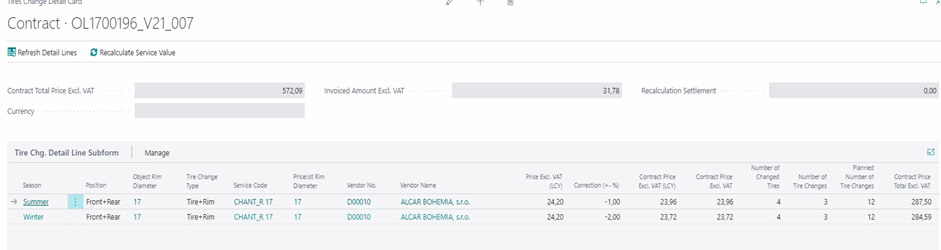

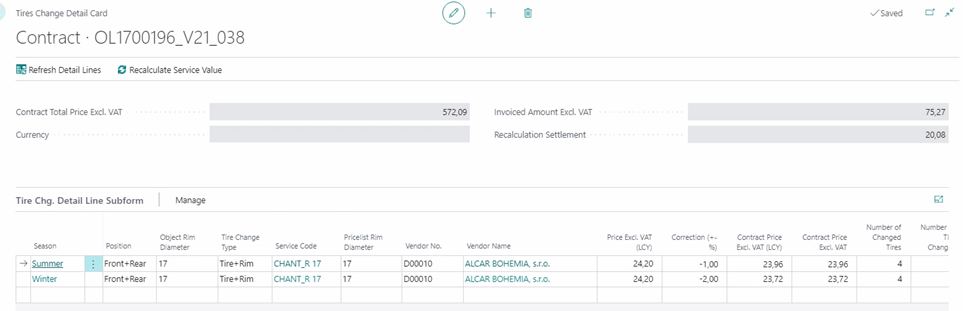

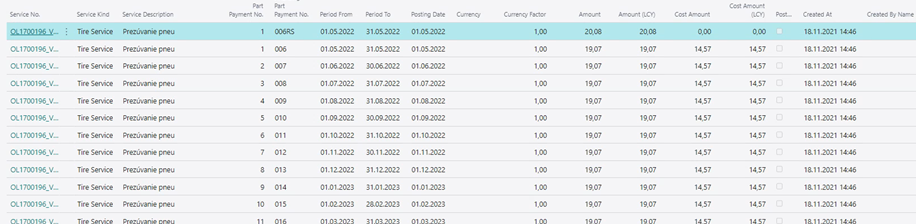

Služba Tire Service/Tire Change

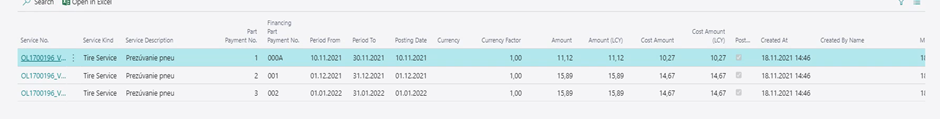

No.=..._007 (time=36M), Service Status=Terminated:

The service was valid from the beginning of the contract (10.11.2021) until the first recalculation (31.1.2022).

The original total value of the service was=572.09

Invoiced Amount Excl.VAT = 2* 15.89= 31.78 (we do not include the first aliquot in the Invoiced amount because the first aliquot is extra). The value will be completed by the first recalculation.

Theoretically Invoiced= always 0 on the first terminated service

Recalculation Settlement=0 on the first terminated service.

Calculation Amount Total (in Contract Services)=after recalculation, the value of Invoiced Amount Excl.VAT from the detail is added.= 31.78 (i.e. without aliquot payment).

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total will no longer be recalculated over the number of installments so that the value corresponds to the installment=15.89

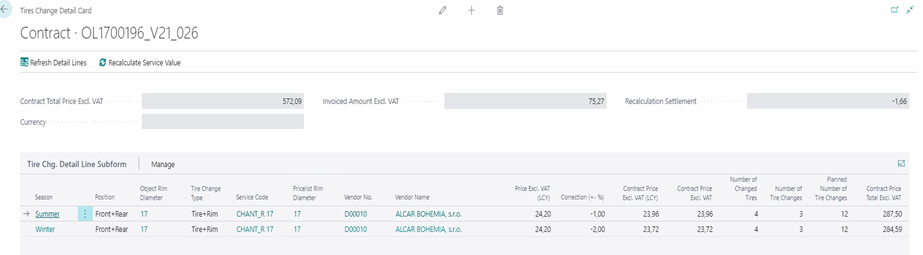

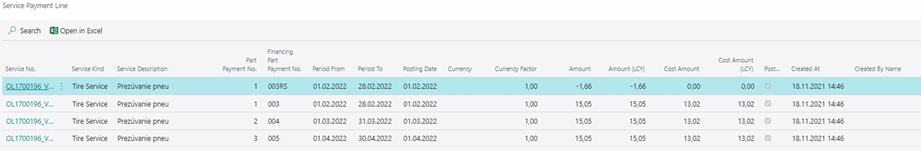

No.=..._026 (time=38M), Service Status=Terminated:

The service was valid after the first recalculation (1.2.2022) until the second recalculation (30.4.2022).

The original total value of the service was=572.09

Invoiced Amount Excl.VAT = (first service 2*15.89=31.78)+(second service -1.66+3*15.05= 43.49)=75.27 (after the first recalculation there was 2*15.89=31.78. In the second recalculation, it was converted to the total value from the first and second services, including the RS from the second service).

Theoretically Invoiced=2*15.05=30.12 (from a tempo contract that was on the same based on the same conditions. However, the value is written during the first recalculation when this service is created.

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT from the first payment = 30.12 - 31.78 = -1.66 – calculated after the first recalculation, it is on the service detail also in the payment cal. RS Line Services.

Calculation Amount Total (in Contract Services)=after recalculation, the value of Invoiced Amount Excl.VAT from detail is added=75,27

Calculation Amount Per Payment=on terminated service after writing Calculation Amount Total not recalculated over the number of installments to match the amount of the installment = 15.05

No.=..._038 (time=30M), Service Status=Preparation:

The service is valid after the second recalculation (01/05/2022) until the end of the contract (31/05/2024).

The original total value of the service was=572.09

Invoiced Amount Excl.VAT = is the sum of invoiced payments from the same service, without the first aliquot payment but including posted recalc.settlements, taken from the previous service = 75,27

Theoretically Invoiced= 5 x 19.07 = 95.35 from the Tempo Service (spk.cal. from the second contract):

Recalculation Settlement= Theoretically Invoiced – Invoiced Amount Excl.VAT = 95.35-75.27=20.08 Rec.Settlement is invoicing:

Calculation Amount Total (in Contract Services)=after recalculation it will be completed (total value 572.09 - Theoretically Invoiced 95.35) = 476.74

Calculation Amount Per Payment=Calculation Amount Total=476.74/25 = 19.07

If we compare this instalment and the service instalment from the contract without recalculation, we can see that the values are the same.

-

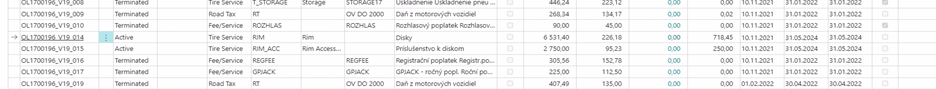

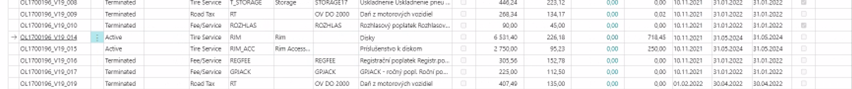

Rim Service

The service shows that it was only extended to the end of the contract (without recalculation), only the installments were recalculated:

13, Rim Accessories Service

The service shows that it was only extended to the end of the contract (without recalculation), only the installments were recalculated: